CLASSIFIED DOSSIER: EYES ONLY

The Unredacted C.O.R.E. File: A Framework for Strategic Value Orchestration

By Zoheb Shah

Summary of Report – Case Briefing

Procurement now sits at a crossroads. No longer viewed as simply a low-cost “back office” function, procurement must now evolve to become a higher-value, more strategically-oriented function, capable of leading the charge to digitally transform the supply chain ecosystem.

My experiences in some of the world’s most demanding sectors have consistently demonstrated that the increasing volatility of global supply chains, the rapid pace of technological advancements, and changing business models create a compelling case for this evolution. This report outlines a definitive roadmap to achieve this evolution, identifying the need for procurement to play a central role in defining how companies will digitally transform.

The study shows that many digital transformation efforts fail not because of poor technology, but because organisations’ structural and cultural impediments persist: including organisational siloes, conflicting business and back-office priorities, and the pervasive tendency to implement technology before defining a strategy.

These examples demonstrate a fundamental failure of current models to recognise that while procurement must participate in supply chain transformation, it is uniquely positioned to provide leadership and guidance throughout the transformation process.

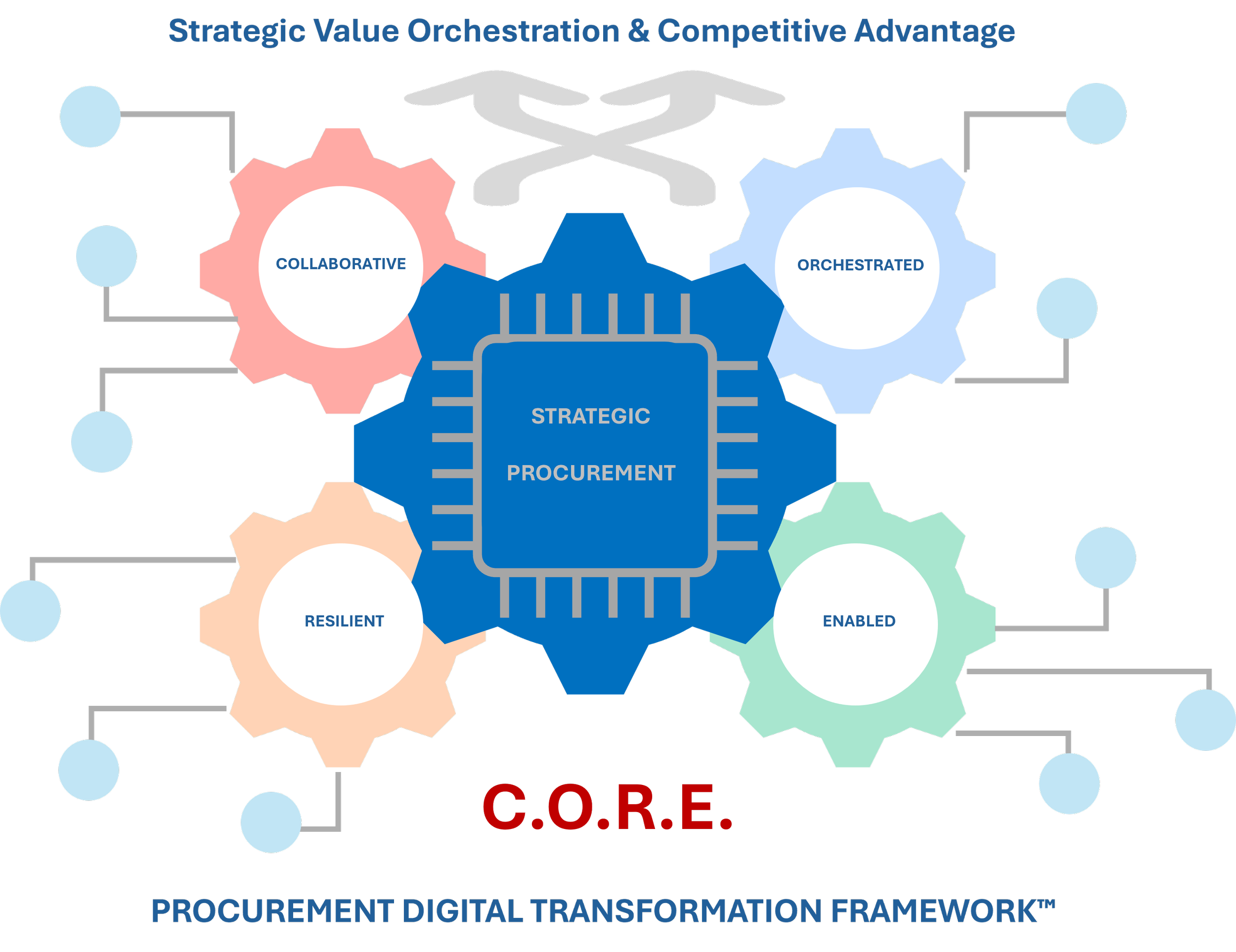

In order to address this gap in current models, this report presents the C.O.R.E. Procurement Digital Transformation Framework (PDTF)TM. The PDTF is a novel, proprietary model that places the disciplined procurement function at the center of the digital transformation effort, and empowers procurement to deliver value across the organisation. The PDTF is composed of four interconnected pillars, each based on the level of operational discipline required to operate effectively in high-risk situations:

C - Collaborative (The Ecosystem Strategy): This pillar focuses on breaking down the internal and external silos that are a major contributor to the loss of value that I commonly experienced in large infrastructure and public sector project procurements. It advocates for creating a single, unified value ecosystem that integrates with all stakeholders and evolves supplier relationships from transaction-based to strategic partnerships.

O - Orchestrated (The Command and Control Model): This pillar goes beyond fragmented, uncoordinated processes, and creates a centrally-managed, vision-led strategy. By drawing on the best practices from Defence and large-scale operations, it advocates for designing a next generation operating model, and for creating a Value Management Office (VMO) to ensure that all procurement activities are aligned with corporate objectives, and maintain a single, clearly-defined line of strategic direction.

R - Resilient (The Risk Arsenal): This pillar embeds proactive risk management and agility into the DNA of sourcing and supplier performance management. It advocates for transitioning from reactive crisis management - a frequent requirement in unstable Telecommunications supply chains - to predictive risk intelligence, and for embedding resilience into the very design of the supply network.

E - Enabled (The Foundational Discipline): This pillar represents the foundational layer of transformation. It emphasises the critical need for developing a high-quality data base, a cohesive and integrated set of digital tools, and developing human talent and a culture of data-driven decision making, in order to establish the operational discipline required to ensure optimal performance of the entire system.

This report provides a phased, practical roadmap for implementing the C.O.R.E. framework. Ultimately, it is a strong call to action for companies to empower the procurement function to take the lead in transforming the supply chain into a resilient and competitive supply chain - with the discipline, strategy, and authority of the Procurement Detective.

Re-mapping the Underworld: The Synergistic Relationship Between Procurement and Supply Chain Management

To create a forward-thinking procurement function, you must first destroy the legacy assumptions about its role. The typical hierarchical view - a relic I frequently found in strict hierarchical organisations like Defence and large public transportation systems - views procurement as a preliminary stage or a subset of Supply Chain Management (SCM). This legacy view, which constrains procurement to the tactical implementation of purchasing, completely misses the profound strategic impact that procurement has on the overall performance, resilience, and ability to innovate of the entire value chain. This view must be discredited. A new paradigm is needed, one that is grounded in real-world operations, which recognises the highly synergistic and mutually dependent roles of these two critical functions, and that views Procurement as the lead agency for establishing the commercial underpinnings and strategic supplier intelligence for the effective operation of SCM.

Beyond the Textbook: Evolutionary Definitions

Business functions are defined by the language used to describe them. The definitions of Procurement and SCM reflect a significant shift from operational execution to strategic orchestration.

Traditionally, procurement has been defined by the five rights: procuring the right product, in the right quantity, of the right quality, from the right vendor, at the right price. While fundamentally correct, this view is operationally-focused. Modern definitions of procurement significantly expand the scope of what is included in procurement. Organisations such as the Chartered Institute of Procurement & Supply (CIPS) and the Association for Supply Chain Management (ASCM) now define procurement as a strategic function, responsible for managing all aspects of an organisation’s spend. Included in this definition of procurement are purchasing, market analysis, strategic sourcing, negotiations, contract management, supplier performance management (SPM), and risk mitigation, all in support of generating value and meeting an organisation’s broader business objectives. Thus, procurement has evolved into a function that can positively impact an organisation’s profitability and act as a catalyst for supplier-driven innovation.

Likewise, Supply Chain Management (SCM) is no longer limited to the physical movement of goods, but encompasses the comprehensive design, planning, execution, control, and monitoring of all supply chain-related activities. The purpose of SCM is to create net value, develop a competitive infrastructure, optimise global logistics, synchronise supply with demand, and evaluate performance across the entire supply chain network - from the supplier’s supplier to the end consumer.

The evolution of definitions demonstrates a substantial paradigmatic shift. The previously held view of procurement as a “subset” of SCM is a remnant of a time when purchasing was largely transactional. In today’s business environment, this hierarchical view is obsolete. A procurement decision, e.g., the selection of a sole-sourced supplier for a critical component, fundamentally establishes the supply chain’s risk profile and resilience. A negotiated payment term affects cash flow and working capital for the entire supply chain. As a result, the relationship between procurement and SCM is not one of a parent function and a subordinate function. Rather, they are two co-equal and interdependent functions, each requiring the successful operation of the other for success. This re-orientation is necessary to successfully execute any meaningful digital transformation. It holds that procurement must be an equal and active partner with SCM in designing the overarching strategy, rather than simply receiving directives from SCM.

The strategic contribution of procurement becomes evident when its primary activities are linked directly to the various results for the supply chain. The decisions made in the procurement function produce a series of secondary effects that ultimately form the very DNA of the supply chain.

A Cost-Centric Approach Creates Suboptimal TCO: The common practice of evaluating a potential vendor solely on their per-unit cost is likely to result in suboptimal results when considering total cost of ownership (TCO), which includes many additional considerations including but not limited to, freight costs related to geographic location, inventory holding costs associated with unreliable delivery schedules, and increased costs associated with quality inspections/re-works resulting from variability in parts supplied. Public Transportation systems present a particular example of this consideration because of the long duration of asset lifecycle (often measured in decades); therefore, there is a strong need for Public Transportation Procurement to include total costs, rather than just the initial purchase price, to ensure that the best decision for the organisation is made. A strategic procurement function will consider all elements of cost, from acquisition to maintenance/disposal and support a TCO model that includes those elements, and ensures that the sourcing decisions being made optimise the total value to the organisation, not just the cost of the goods purchased.

Procurement Activities Determine Supply Chain Resilience: Procurement decisions, and thus procurement practices, are the greatest determinant of a supply chain's resiliency. Decisions regarding single-sourcing, dual-sourcing, near-shoring or off-shoring and supplier consolidation/concentration directly affect the likelihood of supply chain disruptions. The case study of Cisco Systems during the 2011 Tohoku tsunami illustrates this concept. Prior to the tsunami, Cisco had designed a very efficient, highly outsourced/lean procurement model that utilised fewer suppliers to minimise costs. While the model worked well during a period of relative stability, it left Cisco's supply chain vulnerable to disruptions and presented a number of single-points-of-failure that were clearly illustrated by the tsunami. As a result, Cisco shifted from a "design for efficiency" to a "design for resiliency" approach. My experiences working with Defence Systems and Telecommunications, both of which require zero-downtime operations, have also demonstrated that procurement is more than simply creating a sourcing plan and that procurement is responsible for the creation of the supply chain risk profile.

Procurement Supports Quality and Innovation: Procurement's supplier evaluation and performance management processes determine the quality of the final product and services delivered to customers. Additionally, given the rapidly changing technology landscape, a large portion of innovation is driven by suppliers. Procurement organisations that move away from the traditional adversarial/low-cost negotiation approaches and instead develop collaborative, long-term relationships with key suppliers can drive significant value through co-innovation, access to new technologies and process improvements initiated by the supplier.

Supply Chain Efficiency and Agility are Dependent on Procurement: The ability of the supply chain to respond to changes in customer demand is directly impacted by the agility of the procurement processes. Procurement cycle times that are too long, contracts that are inflexible, and poor response time from suppliers can severely limit the supply chain's ability to respond to changes in demand. On the other hand, a digital procurement function that has streamlined S2P processes, flexible contract options, and real-time communication between procurement and suppliers can greatly improve the speed and agility of the overall supply chain.

Given these interdependencies, it follows logically that procurement decisions are not simply inputs into the supply chain but are the basic architecture of the supply chain. Ultimately, the procurement strategy is the supply chain design at its most basic. If procurement focuses on optimising for cost, it designs a brittle, high-risk supply chain. However, if procurement focuses on balancing a range of metrics including cost, quality, risk and innovation, then it designs a robust, agile and resilient supply chain. This establishes procurement professionals as supply chain architects and requires them to have the right skills and mindsets to understand and influence the complex trade-offs across the entire system.

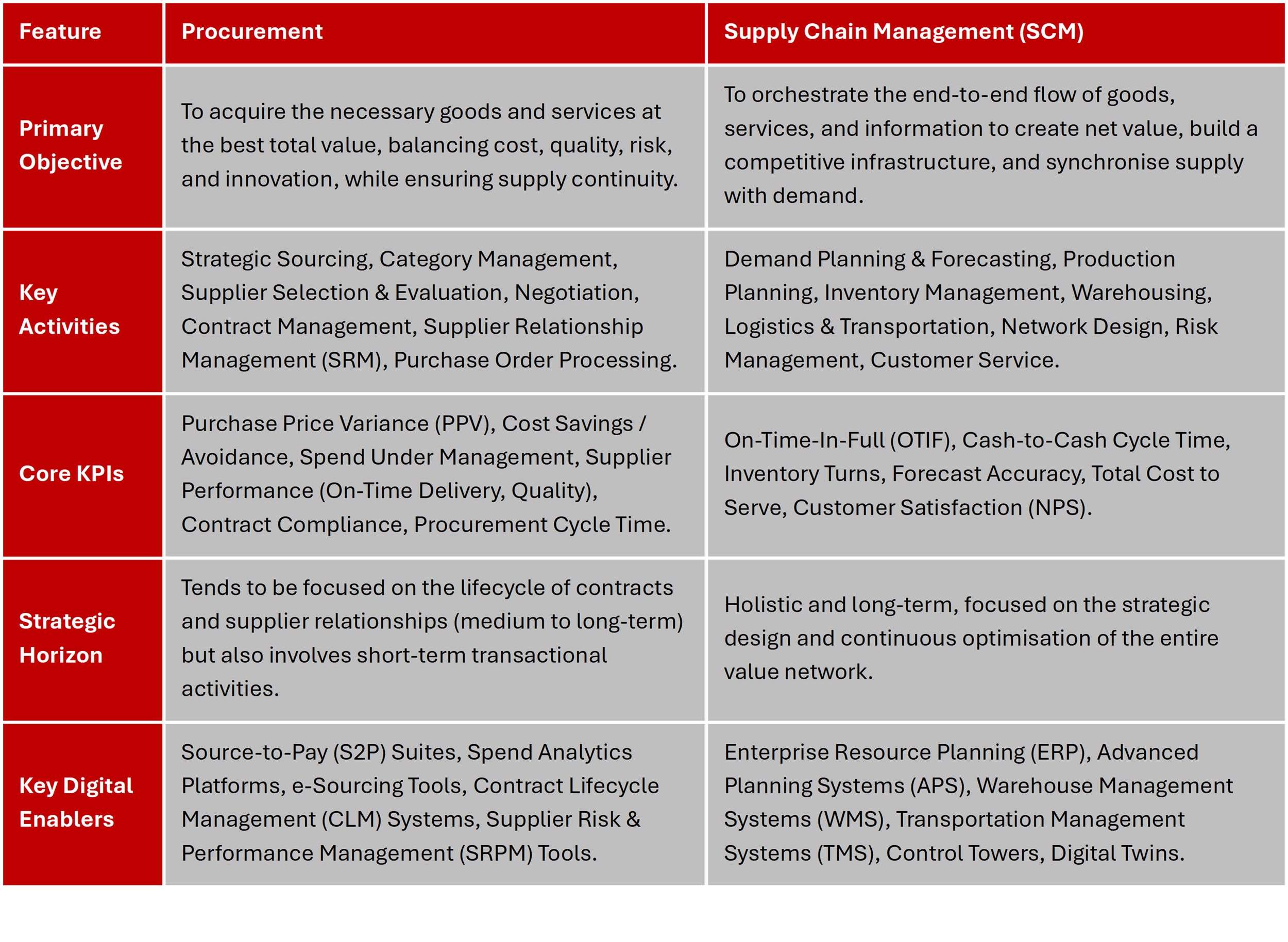

Below is a comparison of the two functions as they relate to today, to provide a basis for linking objectives, metrics and strategic horizons.

Table 1: Procurement vs. Supply Chain Management - A Modern Comparative Analysis

Expert Witness: A Review of the MIT Digital Supply Chain Program

When I took the MIT Digital Supply Chain program, I found that the subject matter was not only extremely modern, but has become an excellent strategic supplement to more traditional functional certifications. At the heart of the course is the Digital Supply Chain Transformation (DSCT) framework. I believe this framework is particularly relevant as it promotes a vision-driven approach, requiring a company to develop its capabilities in three key areas: digital capability; supply chain processes; and the ecosystem of actors. This framework provides a solid defence against "technocentricity", a problem that I have observed cause significant delays in many major initiatives in both the public and private sectors, specifically in the area of large-scale infrastructure projects.

In addition to the DSCT framework, the course also covers a number of other, more advanced concepts that define a supply chain that is ready to face the challenges of the future, including:

Digital threads: The creation of a single, continuous thread of data that runs through each part of the supply chain, connecting them in a way that allows for real-time visibility of demand and supply.

Human-AI Teaming: An advanced discussion of the relationship between humans and machines working together in a supply chain environment and the use of a quadrant matrix to classify the various ways in which humans and machines interact with each other based on their relative levels of risk and complexity.

Resilience by Design: A proactive approach to building resilience into the design of a product or service and into the design of the supply chain itself.

Collaborative ecosystems: The study of digital platforms and the differences between traditional forms of vertical collaboration (between buyers and suppliers) and modern forms of horizontal collaboration (between peers or even competitors).

In comparison to leading professional certifications such as CIPS and ASCM's CSCP, one of the primary distinctions that emerge is the nature of the certification. The CIPS and ASCM certifications provide professionals with a deep, functional understanding of the "what" and "how" of day-to-day operations. In contrast, the MIT certification provides professionals with a strategic "why". While a professional certified by CIPS or ASCM may understand how to effectively negotiate a contract, they lack the strategic framework needed to understand why that contract should be structured for agility and resilience. The true value of the MIT certification lies in its ability to combine both disciplines - the practical expertise of the practitioner, combined with the visionary insight of the architect.

The DSCT framework at the core of the course is aligned with the proprietary models used by the largest and most influential management consulting firms in the world, providing evidence of its validity and relevance:

McKinsey & Company's "Digital Procurement Engine" uses a people-focused methodology ("Set a North Star") and a vision-led approach, which mirrors the DSCT framework's emphasis on starting with a clear vision and developing an integrated ecosystem of actors.

Deloitte's Digital Procurement offering emphasises a digital maturity assessment and the development of a digital strategy prior to any technology selection, which reflects the DSCT framework's cautionary warnings about the dangers of technocentricity.

KPMG's "Powered Procurement" framework uses a comprehensive Target Operating Model with six layers (governance, process, people, technology, etc.) which is a more granular representation of the three main structural pillars of the DSCT framework.

Similarly, Boston Consulting Group (BCG) emphasises that a procurement organisation must establish its core value proposition first and then use AI and advanced analytics to enable it, rather than using them as a starting point.

From the Field: Actionable Insights for the Strategic Procurement Professional

A strategic framework is only as valuable as its ability to guide the actions of those using it. To do so requires a fundamental paradigmatic shift in thinking and a commitment to develop new skills, transforming the procurement function from a process executioner into a strategic internal consultant or, more precisely, a lead investigator of value.

Applying a Supply Chain Perspective to Procurement

The most important aspect is to purposefully embrace a holistic, end-to-end (E2E) supply chain perspective in all your decisions.

Think End-to-End (E2E): Prior to initiating a sourcing event or negotiating a contract, the strategic procurement professional must mentally (and, when feasible, physically) map the potential impact of their decisions throughout the entire value chain. Therefore, ask yourself: How will this supplier's geographical location affect our logistics costs and variability of delivery time? What is his/her tier 2 and tier 3 supply base, and what latent risks exist? How will the quality and reliability of this component impact our manufacturing productivity and, consequently, our end customers' experience? My experience in Defence and large-scale public infrastructure demonstrated that if you don't visit the depot, the network node, or the shipyard, you will never truly know the end-to-end costs. Thinking in terms of E2E transforms a simple sourcing decision into a strategic decision regarding the design of the supply chain.

Adopt Total Value/Cost of Ownership (TVO/TCO): As the traditional procurement metric of Purchase Price Variance (PPV), which measures the difference between standard cost and actual cost, can motivate behaviors that harm the supply chain, a persistent focus on PPV can encourage the selection of suppliers that offer a low unit cost but generate excessive costs in the subsequent stages of the supply chain. The modern professional must therefore advocate for a transition toward Total Cost of Ownership (TCO) or, preferably, Total Value of Ownership (TVO) which considers all costs (logistics, inventory, quality, risk) and the added value generated by the supplier (innovation, speed-to-market). To accomplish this, the professional must have the operational discipline to educate finance and business stakeholders of the limitations of PPV and establish joint KPIs that represent the performance of the entire system.

Become a "Boundary Spanner": Actively engage with engineering, logistics, and planning to eliminate the barriers that prevent the efficient functioning of the enterprise. Since procurement is uniquely positioned to perform this role, instead of waiting for a requisition, the strategic procurement professional must proactively collaborate with engineers during the design phase to identify standard components that minimise complexity. The professional must collaborate with logistics to determine the true freight costs of the various sourcing options. The professional must collaborate with planners to communicate with suppliers to obtain accurate forecasts of demand. This proactive, multi-functional interaction is essential, especially in industries that rely heavily on assets, such as public transportation and telecommunications, where the failure to coordinate supply planning with engineering roadmaps generates tremendous friction and inefficiencies.

Strategies for Successful Digital Enablement

Transformation must be viewed through the lens of a value-focused, practical methodology, and The Procurement Detective is focused on the commercial crime, not the shiny new technology.

Start with the Pain Point, Not the Technology: Always start with the identified business problem and the desired outcome when looking at a new technology investment to ensure the technology investment creates tangible value.

Do not let your enthusiasm for a new piece of technology get ahead of you - do not make the rookie mistake of buying a high-end solution without first identifying the specific value leakage you want to prevent.

Data Governance: Essential to Success

Advanced technologies including Artificial Intelligence (AI) and Predictive Analytics rely on the quality and availability of the underlying data. A model trained on bad (incomplete/inaccurate) data will produce outputs that are bad and unreliable. Poor data is not just an inconvenient condition - it is a huge risk factor for companies in sectors where operational integrity is mission-critical (i.e. Defence and Telecommunications). Therefore, Procurement Leaders must champion data governance. This includes leading initiatives to create a "single source of truth" for critical data domains, including supplier master data (to ensure there is only one unique record for each supplier), contract data (digitise and centralise all agreements), and spend data (develop a common taxonomy for spend classification).

Creating a Single Source of Truth is the necessary foundation to support operational stability and to enable the use of advanced analytics in your company.

Pilot and Scale: Implementing New Technologies in a Safe and Cost-Effective Manner

Implementing new technologies in large-scale "big bang" implementations is a recipe for disaster. In addition to the cost of failed implementations, many Public Sector and Infrastructure projects fail due to the risks associated with the "big bang", resulting in large amounts of tax payer dollars being written off. A better way to implement new technologies is to implement them in phases - i.e. "start small and act fast". Select a high-impact, low complexity area for a pilot project - e.g. implement an electronic sourcing tool for a single spend category with a clear definition of requirements. The purpose of the pilot is to quickly demonstrate a measurable benefit using the new technology and process. Once the pilot has demonstrated the benefits of the technology and process, the next step is to leverage the results of the pilot to gain additional buy-in, develop a scalable playbook for implementing the solution throughout the rest of the organisation, and ultimately to obtain approval for the full budget for implementation.

Evolution of Supplier Relationships in a Digital World

Supplier relationships must shift from transactional/adversarial to collaborative/resilient in today's digital/volatile world.

Identify Areas of High-Risk and Leverage Segmentation Strategies

It is unrealistic to expect to have deep, strategic partnerships with all of your suppliers. Therefore, it is critical to apply segmentation strategies to help prioritise the limited resources available. Suppliers should be segmented based on total spend, criticality, and risk. With segmentation, you can develop different approaches for your suppliers. Strategic partners who represent a high percentage of your spend, pose a high level of risk, etc., will require close collaboration and joint business planning. Suppliers who represent low levels of spend, pose a low level of risk, etc., will require highly automated, efficient transactional systems. This methodical approach is reflective of the operational realities found in Asset-Intensive Sectors, where resources are scarce and focus must be directed at the critical suppliers whose failure could cripple the entire supply chain.

Resilience Must Be Built Into Contracts

A modern, resilient contract builds upon the traditional contract that focuses primarily on price, delivery, and liability. In response to the lessons learned from the Cisco Case Study, procurement professionals must include new provisions into their standard agreements with critical suppliers. Based on my experience in Defence Systems, I know that resilience is a non-negotiable term of service. A modern contract must require that critical suppliers provide transparency into their Business Continuity Plans, allow access to their Key Tier 2 Suppliers, establish protocols for Collaborative Scenario Planning, and define Shared Risk Models for Managing Unforeseen Disruptions. A modern contract must be able to be used as a dynamic tool for proactively managing risks, as opposed to being a static legal document.

Create Value Through Collaboration

The ultimate objective of SRM is to transition from the negotiating table (where value is often perceived as a zero sum game) to a collaborative workspace (where value is created together). To accomplish this, procurement professionals need to collaborate with their strategic suppliers on joint initiatives to eliminate inefficiency, reduce waste, increase sustainability and promote innovation. This may involve collaborating on a Joint Process-Mapping Exercise to identify areas of inefficiency, a Shared Innovation Workshop to generate ideas for new product features, or a Collaborative Initiative to Reduce Carbon Footprint of the Shared Supply Chain. In sectors like Public Transportation, creating value collaboratively is no longer an option - it is the means to achieve multi-decade major outcomes (such as Fleet Decarbonisation).

Implementation of these practical strategies necessitates a fundamental shift in the skills required by the procurement professional. It requires that the procurement professional move away from the traditional competencies of negotiation and purchasing and acquire the competencies of an Internal Consultant: Diagnosing Business Problems, Analysing Data, Facilitating Cross-Functional Teams, Managing Change, and Communicating Strategically. The procurement professional does not simply execute a predetermined buying process; instead, he/she diagnoses business problems, designs value-driven solutions, and orchestrates the implementation of those solutions across multiple internal and external stakeholders. This redefinition of the role is essential to achieving the true strategic potential of the procurement function.

🟢 The C.O.R.E. Procurement Digital Transformation Framework (PDTF): A Structured Model to Lead Digital Change in Organisations

Existing frameworks provide a general overview of how to implement a digital transformation strategy, however, they lack a strategic perspective: They do not contain a dedicated framework designed specifically for and by the procurement function to lead digital change. The C.O.R.E. (Collaborative, Orchestrated, Resilient, Enabled) Framework addresses this strategic void and offers a proprietary model built around operational discipline.

This framework positions procurement as the central nervous system of the transformation, not as a part of it. The C.O.R.E. Framework is a structured, comprehensive, and actionable model for procurement leaders to take control of and guide their organisations towards a future state of digital maturity. The four pillars of the C.O.R.E. Framework are not sequentially staged capabilities, but rather four interconnected and mutually reinforcing capabilities that must be developed in tandem to achieve transformative performance.

The Need for a Procurement-Centric Framework

There is a logical basis for a procurement-centric framework. Procurement decisions represent the architectural DNA of the supply chain. The choice of suppliers, the terms of contracts and the nature of the relationship with suppliers define the characteristics of the supply chain including cost, agility, resilience and innovation potential. A procurement centric transformation therefore does not simply address the symptoms of systemic fragility - it also addresses the root causes of that fragility. The C.O.R.E. framework provides the roadmap to deliver that foundational change and empower the disciplined procurement professional to deliver change from the inside out and provide the commercial and risk foundations for the entire enterprise.

🟡 Pillar 1: COLLABORATIVE - Creating the Value Ecosystem

This pillar addresses one of the biggest challenges faced by organisations today - the existence of functional and organisational silos. In the digital age, value is created not through individual departments working in isolation but through connected networks. This pillar addresses the need to dismantle the barriers that prevent seamless ecosystems of value creation from being developed. I have seen firsthand throughout my career in high dependency industries that silos are not merely inconvenient, but they are the primary architects of failure and wasted capital.

Internal Collaboration: Removing the Walls

This section addresses removing the traditional walls that exist between procurement and other internal functions. It involves going beyond the transactional hand off of requisitioning and the development of deep early stage integration. This is achieved by the formation of formal cross-function teams for key categories, the development of shared KPIs to align the objectives of procurement with finance and operations and the development of joint business planning processes to ensure sourcing strategies are developed in conjunction with and not in response to business strategy. Developing this level of collaboration is necessary to maximise the return on investment in large-scale infrastructure and technology projects.

External Collaboration (SPM 2.0): Establishing Partnerships

This section describes the evolution of supplier performance management (SPM) from a compliance/performance monitoring activity into a proactive vehicle for creating value together with suppliers. For a small group of strategic suppliers, this will involve establishing deep trust-based partnerships characterised by a high level of transparency, joint innovation programs, co-investment in new technologies and shared risk/reward models. The objective is to evolve the supplier base from a source of cost savings to a source of competitive advantage. This is the essence of modern category management - converting high risk suppliers into high value collaborators.

Horizontal Collaboration: The Intelligence Network

This section describes the use of digital platforms as inspiration for encouraging procurement to identify and support opportunities for horizontal collaboration with peer organisations or non-competitive organisations. Horizontal collaboration can take many forms, including co-sourcing non-critical goods to leverage purchasing power, sharing logistics capacity to improve efficiency/sustainability, and sharing anonymous risk intelligence on common supply markets. This section recognises that an organisation's intelligence network is much larger than the boundaries of the organisation itself and exists globally.

🟡 Pillar 2: ORCHESTRATED - Moving from Processes to Performance

This pillar addresses the strategic discipline and governance that are needed to drive the transformation. This pillar ensures that digital transformations are not implemented as random acts of technology implementation, but rather as part of a cohesive, value-focused program that supports enterprise goals. This is the Command and Control element of the C.O.R.E. framework.

Vision-Based Strategy: The North Star

This section describes the first element of the C.O.R.E. framework, which is establishing a clear and compelling 'vision' for the future state of the procurement function. This vision should be clearly articulated by the Chief Procurement Officer and their leadership team and must be explicitly linked to the corporation-wide strategy. The vision should act as the ultimate filter for prioritising all initiatives to implement the transformation. This concept is based upon the premise of the core tenets of the MIT Digital Supply Chain Transformation (DSCT) framework and is referenced in the transformation models of the leading consulting firms, such as McKinsey. If a company does not develop a clear strategic vision, the various teams in large organisations (such as defence or transportation) will likely prioritise their own interests, resulting in a fractured transformation initiative.

Next Generation Operating Model: Tactical Redesign

The digital strategy cannot be successful if applied to an analog organisational structure. This section outlines the need for a fundamental redesign of the procurement operating model, which includes its structure, processes, governance and people skills. This could include creating an analytics and market intelligence CoE, building agile category-based teams and streamlining S2P processes to provide a seamless user experience for the business stakeholders. The purpose of this tactical redesign is to eliminate bureaucratic friction and to enable high speed execution.

Value Management Office (VMO): The Accountable Scorecard

Procurement must demonstrate its strategic contributions and cannot solely rely on measuring PPV and cost savings. The VMO is a dedicated capability that defines, measures and communicates the complete range of value that is provided by the procurement function. This includes tangible measures of cost reductions/avoidances, risk mitigation (i.e., reduction in supply chain disruptions), supplier-led innovations (i.e., # of new products launched utilising supplier technologies), and sustainability benefits (i.e., # of tons of SCOPE 3 CO2 emissions reduced). In high capital environments, the VMO serves as the central intelligence hub that tracks and holds accountable each strategic decision made by the organisation against its over-arching mission.

🟡 Pillar 3: RESILIENT - Designing for Disruption

This section addresses the imperative of conducting business in a rapidly changing environment. It addresses the requirement of embedding risk management as a design principle in every sourcing decision and thus becoming more resilient.

Proactive Risk Intelligence

This section establishes the requirement for transitioning from static risk assessments to real-time risk sensing using AI to continuously monitor a variety of data sources for early warning signs. Proactive risk intelligence is vital for managing global supply chains (for example, telecommunications infrastructure) where changes in geopolitics, commodity prices and/or natural disasters in distant Tier 2 locations can present existential threats.

Resilience by Design

This means incorporating resiliency factors into the strategic sourcing process and deliberately making trade offs between cost and resiliency. This results in strategic sourcing decisions related to supply base diversity, geographically concentrated supplies, inventory policies, and component standardisation. Resilience by design incorporates concepts from defence to ensure that the system can absorb impacts and continue to operate without failure, recognising that while efficiency is important in a volatile environment, efficiency without resiliency is fragile and often catastrophic in high stakes environments.

Agile Contracting

As the global economy continues to experience increasing volatility, long-term, fixed-price contracts will increasingly represent a liability. Agile contracting refers to developing more flexible and dynamic contract structures. Examples of agile contract structures include provisions that allow for price adjustments tied to indices, flexible volume commitments, and shared risk/reward agreements to manage volatility and predetermined protocols for invoking alternative sources of supply in the event of a disruption. Contracts can be transformed from static pieces of law into dynamic risk management tools.

🟡 Pillar 4: ENABLED - The Foundation

The fourth and final pillar represents the foundational elements that support the other three pillars - data, tools and talent. Absent a solid foundation of operational discipline, any C.O.R.E. transformation effort will be doomed to fail.

Data & Analytics: The Intelligence Base

This is the base of digital procurement. It starts with establishing a strong data governance model and creating a single source of truth for spend, supplier and contract data. On top of this foundation, the organisation can build a series of progressive analytical capabilities starting with descriptive analytics (what has occurred?) and ending with predictive analytics (what will occur?). Descriptive analytics is typically represented by spend cubes and dashboards; diagnostic analytics identifies why something has occurred; predictive analytics forecasts what will occur (commodity pricing, supplier lead times); and finally, prescriptive analytics identifies what actions should be taken to optimise sourcing strategies and negotiations. Data & analytics mirrors the non-negotiable requirements of data integrity inherent in Defence and Telecommunications networks.

Digital Tools & Technology: The Modular Arsenal

This section addresses the need to create a comprehensive and user-centric technology stack. The objective is to avoid the "Frankenstein Effect," where digital transformations result in multiple unconnected systems by creating a modular yet integrated suite of digital tools and technologies, often centered around a S2P platform. Any digital tool selected must be determined by the needs of the business and the user experience and must achieve high utilisation and compliance. The technology must support the strategy, not define the strategy.

Cultural Transformation: Enabling a Data-Driven Mindset

While each of the three previous sections will ultimately contribute to an organisation’s successful transformation, Cultural Transformation represents the most impactful aspect of this process. This section focuses on creating an organisational culture which promotes, supports and encourages, the use of data to drive business decisions, fosters a culture of continuous learning and innovation, and views procurement as a strategic business partner. Cultural Transformation requires a significant investment in upskilling and reskilling the current employee base to have the hybrid skills required to be successful in a digital procurement environment (i.e., data analysis, digital literacy, strategic relationship building). In addition to investing in the development of the current employee base, organisations need to attract new employees who possess the same hybrid skills that are required to be successful in a digital procurement environment. As a Procurement Detective, I firmly believe that talent and culture are not soft components – rather, they represent the strategic assets that can make or break an organisation's overall success or failure within the C.O.R.E. Framework.

The C.O.R.E. Framework provides a holistic, integrated and procurement driven approach to successfully navigating the complexity of Digital Transformation. Ultimately, it positions the procurement function as a strategic leader and architect of a resilient and value-based supply chain.

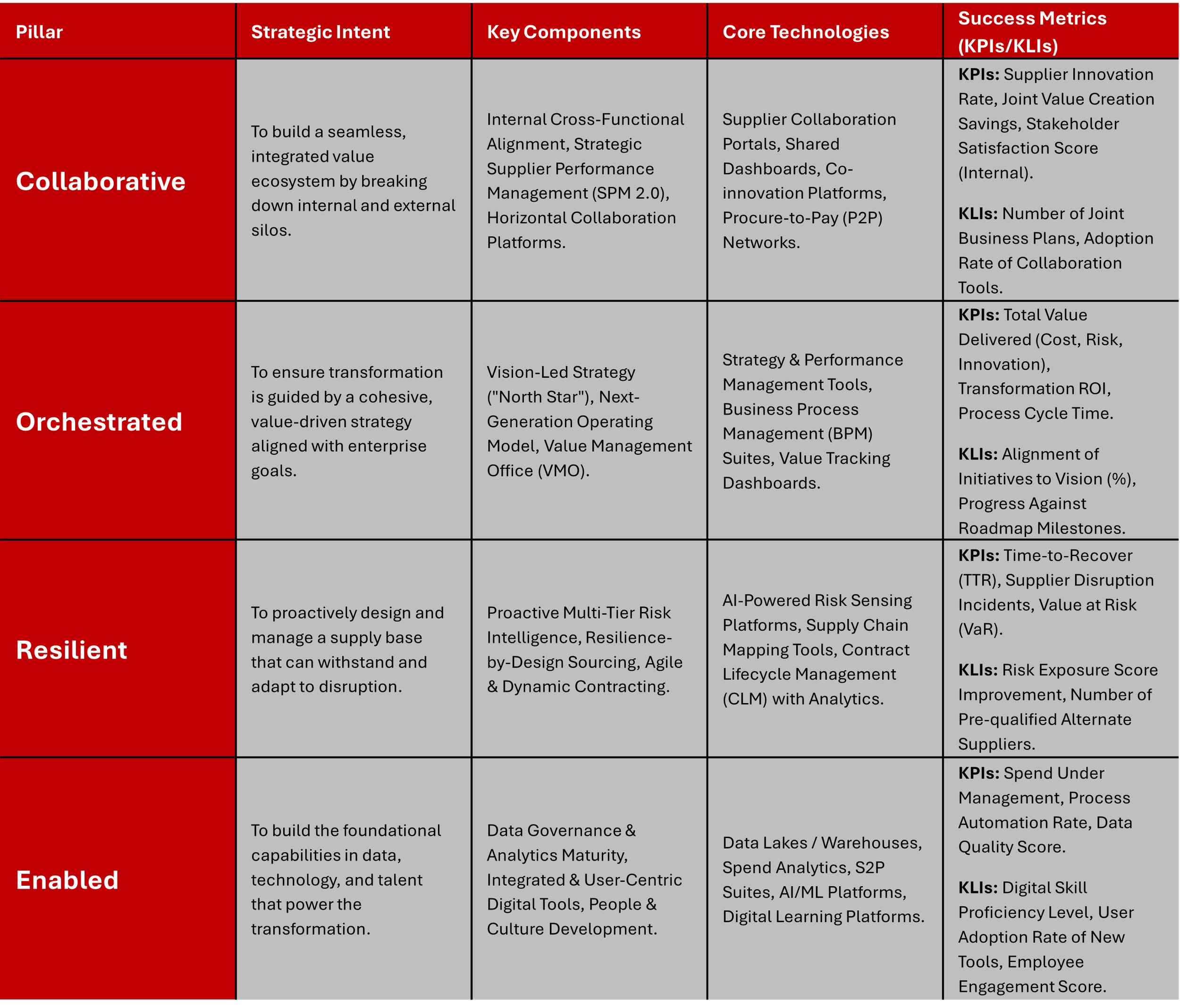

Table 2: The C.O.R.E. Framework - Component Breakdown

Executing the Sting: A Strategic Roadmap

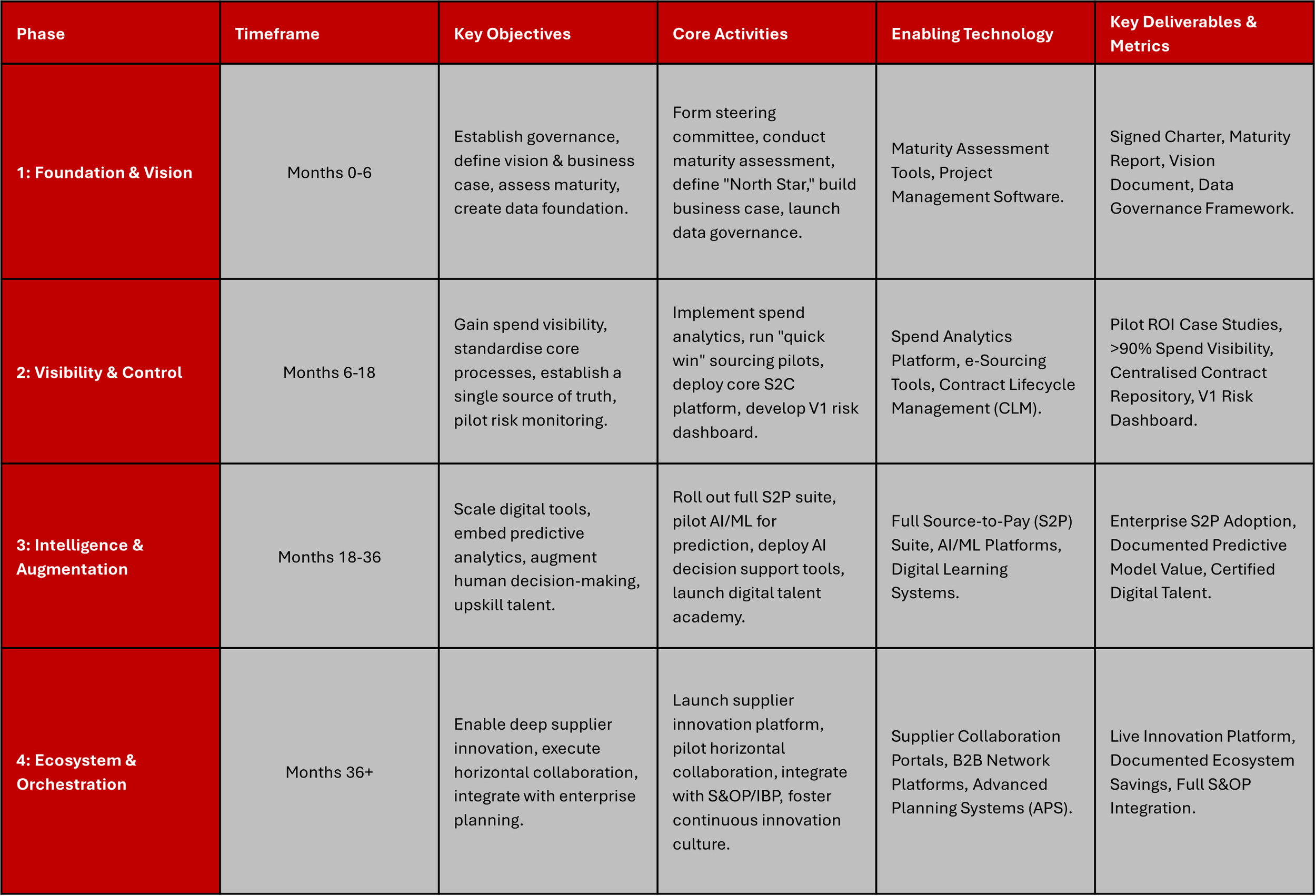

While the C.O.R.E. Framework outlines a compelling vision for the next-generation procurement function, it is only through the execution of a well-planned roadmap that the vision will be realised. In this section, we outline a strategic roadmap to achieve the goals outlined in the C.O.R.E. Framework. This roadmap defines a multi-phased approach that establishes a strong foundation for the transformation effort, delivers early wins to prove the value of the transformation, and scales success over time to ensure the transformation is both manageable and sustainable. Each phase of the roadmap includes clear objectives, core activities, and measurable deliverables to guide the organisation from its current state to a future state of digitally-enabled procurement excellence.

Phase 1: Foundation & Vision (Months 0-6) - "Casing the Joint"

Phase 1 is focused on laying the ground work for the remainder of the transformation effort. It is during this phase that the organisation will establish the strategic, organisational, and data-related foundations required for the transformation. Rushing this phase is a common cause of failure; a strong foundation is necessary to prevent structural collapse in subsequent phases.

Objective 1: Secure Executive Sponsorship and Define the Transformation Vision and Business Case

Establish a Cross-Functional Steering Committee: Identify and assemble a cross-functional steering committee comprised of senior executives with direct responsibility for the procurement function. Obtain sponsorship from the CPO, CFO, and CSCO to provide oversight, resource allocation, and removal of organisational barriers to the transformation.

Develop the North Star Vision Statement: Conduct a series of workshops with key stakeholders to develop and articulate the long-term vision for the procurement function. This vision statement will serve as the guiding principle for all subsequent decisions.

Objective 2: Assess Current State and Determine the Required Level of Digital Maturity

Conduct Digital Maturity Assessment: Complete a comprehensive assessment of the procurement function's current capabilities across the four C.O.R.E. pillars. Use a model similar to the one developed by Deloitte to identify key strengths, weaknesses, and gaps and establish a clear, unbiased baseline.

Objective 3: Develop the Business Case for the Transformation

Quantify Benefits: Develop and quantify the expected benefits of the transformation, including cost savings, risk reduction, efficiency gains, and innovation potential. The business case will be essential for obtaining long-term funding and commitment and demonstrating the financial justification for the transformation.

Objective 4: Launch Data Governance Initiative

Cleanse, Standardise, and Centralise Critical Procurement Data: Initiate a project to clean, standardise, and centralise critical procurement data. Start with supplier master data and spend data. Establish data stewards and clearly define governance policies. This will ensure the integrity of the intelligence used in all subsequent phases.

Deliverables & Metrics: Signed Project Charter with Executive Endorsement; Detailed Digital Maturity Assessment Report; Documented "North Star" Vision Statement and Business Case; Data Governance Framework Document; and Formation of the Transformation Steering Committee.

Phase 2: Visibility & Control (Months 6-18) - "The First Takedown"

The objective of Phase 2 is to quickly gain traction and demonstrate value to the organisation. This phase is focused on gaining digital control over core procurement processes and building momentum for the transformation. The goal of Phase 2 is to secure the perimeter of the organisation and demonstrate the power of your new intelligence.

Objective 1: Gain Unassailable Visibility Into Enterprise-Wide Spend

Deploy Spend Analytics Solution: Implement a spend analytics solution to consolidate, cleanse, and classify spend data from all source systems. This will provide, for the first time, a complete and accurate view of what the organisation is purchasing and from whom. This is the core intelligence needed to fight the crime; you cannot fight the crime until you have identified the victim's full financials.

Objective 2: Standardise Core Sourcing and Contracting Processes

Launch "Quick Win" Sourcing Pilots: Pilot two to three high-impact, low-complexity categories and run strategic sourcing events using modern e-sourcing tools. Track and report the savings and efficiencies gained to build credibility and obtain additional investment.

Objective 3: Establish Single Source of Truth for Procurement Data

Deploy Core Source-to-Contract (S2C) Platform: Implement the sourcing and contract lifecycle management (CLM) modules of a core S2P platform. Migrate all existing contracts into a central, searchable digital repository and standardise the process for all new sourcing events and contract approvals. The contract register is the ultimate source of truth; digitising it secures your future liability.

Objective 4: Pilot Proactive Risk Monitoring Capability

Develop Risk Dashboard V1: Create a prototype of a supplier risk dashboard. Integrate data from financial risk providers and internal supplier performance metrics to provide a consolidated view of risk across the top strategic suppliers. This will introduce the proactive aspect required for organisations like Public Transport and Defence.

Deliverables & Metrics: Documented case studies from successful pilot projects demonstrating ROI; Live Spend Analytics Platform with >90% of Addressable Spend Classified; Live, Centralised CLM Repository; V1 Supplier Risk Dashboard; Increase in Spend Under Management; Reduction in Sourcing Cycle Time.

Phase 3: Intelligence & Augmentation (Months 18-36) - "Turning Pro"

Phase 3 represents the most significant step towards the realisation of the C.O.R.E. Framework. This phase is focused on transitioning from simply automating existing processes to using advanced analytics and AI to augment the capabilities of the procurement team and enable more strategic and predictive decision-making.

Objective 1: Scale Digital Tools and Processes Across the Enterprise

Expand S2P Platform: Expand the S2P platform across the enterprise, embedding predictive and prescriptive analytics into decision making, and launching a formal program to build the digital skills of the procurement team.

Objective 2: Embed Predictive and Prescriptive Analytics into Decision Making

Introduce Predictive Analytics: Pilot AI/ML for predictive use cases. Examples may include forecasting key commodity prices to inform hedging strategies, predicting supplier lead times to improve planning accuracy, or identifying potential supplier quality issues based on production data. This enables the procurement team to move from merely reacting to market forces to proactively anticipating them.

Objective 3: Provide Category Managers with Augmented Decision Support

Deploy Augmented Decision Support: Implement AI-powered tools to support category managers. Examples include a negotiation support tool that provides real-time market intelligence and suggests optimal negotiation tactics (such as BCG's AI Negotiation Coach) or a tool that automatically flags non-standard or high-risk clauses during contract review. The objective is to empower your operatives with digital foresight so they never enter a negotiation unarmed.

Objective 4: Build Digital Capabilities within the Procurement Team

Launch Digital Talent Academy: Develop and launch a dedicated training and development program to upskill the entire procurement team in critical areas such as data analytics, digital technology, and strategic supplier relationship management. This will ensure the human engine driving the system is certified and equipped to interpret the advanced intelligence being generated.

Deliverables & Metrics: Enterprise-Wide Adoption of the S2P Platform with High User Satisfaction Scores; Documented Value and Improved Accuracy from Predictive Analytics Models; Successful Deployment of at Least One AI-Augmented Decision Support Tool; Procurement Team with Certified Digital Skills.

Phase 4: Ecosystem & Orchestration (Months 36+) - "Running the City"

Phase 4 represents the highest level of maturity within the C.O.R.E. Framework. At this point, the procurement function will transcend its traditional role to become a true orchestrator of value across a broad digital ecosystem. At this point, Procurement will not be instructed to act; rather, Procurement will assist in developing the corporate agenda.

Objective 1: Develop Supplier Innovation Platform

Develop Supplier Innovation Platform: Launch a digital platform to capture, evaluate, and manage innovation ideas from the supply base. Create a structured channel for co-creation and turn SRM into a tangible source of new value. Formalise the supplier base as an external R&D Engine.

Objective 2: Explore Horizontal Collaboration Opportunities

Explore Horizontal Collaboration: Identify and pilot horizontal collaboration opportunities, such as shared logistics or co-procurement of indirect services with other companies. Utilise digital platforms to manage these complex relationships and demonstrate the function's ability to create value outside of the internal organisational chart.

Objective 3: Integrate with Enterprise Planning

Integrate with Enterprise Planning: Embed procurement's data and predictive insights (e.g. supply risk, inflation forecasts, and supplier capacity) into the corporation's sales and operations planning (S&OP) or integrated business planning (IBP) process. This is the ultimate elevation of Procurement and ensures that strategic business decisions are made with a complete and forward-looking view of the commercial and supply landscape, as is the case in Public Transport and other critical infrastructure.

Objective 4: Foster Continuous Innovation and Improvement

Foster Continuous Innovation: Evolve the procurement operating model to a state of continuous improvement and innovation, where new digital tools and process enhancements are continuously tested and deployed.

Deliverables & Metrics: Live Supplier Innovation Platform with Active Engagement and Pipeline of Funded Projects; Successful Horizontal Collaboration with Documented Benefits; Full Integration and Active Participation in Corporate S&OP/IBP Process; Procurement Function Recognised across Enterprise as Strategic Partner and Leader in Digital Transformation.

This phased roadmap provides a structured, logical, and achievable path for implementing the C.O.R.E. framework. The following table summarises the key elements of this journey.

Table 3: Phased Implementation Roadmap for the C.O.R.E. Framework

The Procurement Function as a Value Orchestrator - The Final Verdict

What has been described in this report, is a radical shift in how procurement sees itself and what it does strategically. A symbiotic relationship with the Supply Chain and a whole system approach (such as that provided by C.O.R.E.) must enable procurement to transition from its historic status as a transactional 'buying' center to a new, indispensable, strategic position as a Value Orchestrator.

In addition to a new identity as a Value Orchestrator, procurement will experience a significant shift in what it values most. The Value Orchestrator will be less focused on the cost of each transaction, than totally focused on the total value generated by all the transactions. In the context of the operational aspects of large scale infrastructure and critical service operations, this represents the difference between failure and systemic failure.

For those looking to lead this change, the future ready procurement professional will need to develop an expanded range of skills. Beyond traditional commercial skills, they will also need to demonstrate a high level of literacy around data, an ability to think strategically about the use of technology and a range of skills that support the management of change. This may include the skills of an internal consultant, a collaborator across functions and a Digital Evangelist.

C.O.R.E. provides the strategic road map to support this transformation, whilst the Implementation Road Map provides the practical steps to take to deliver it. The route ahead will be difficult and will require continued commitment, Executive Sponsorship and a preparedness to challenge previous assumptions. However, the reward will be in direct proportion to the effort required.

For any organisation looking to create a supply chain that is both Competitive, Agile and Resilient in the 21st Century, there is one clear message: the transformation must start with the Empowerment and Digitalisation of the Organisation's Procurement Function. For Leaders, the real issue now is not whether or not this transformation is needed but rather, who in their organisation will have the Vision and Operational Courage to Lead It.

© 2025 Procurement Detective